By STEPHEN FIDLER

THE HAGUE, the Netherlands—The director of Europol, the agency coordinating the work of police forces across Europe, says that the European Union needs to address weaknesses in the way it tracks terrorist finances—and that his agency is well placed to address them.

Rob Wainwright, who since April 2009 has run the agency leading the EU’s serious-crime-fighting effort, says organized crime is increasingly an international enterprise that demands an international response. This translates into “an increased market opportunity” for Europol to play a coordination role between national police authorities.

In an interview at Europol’s headquarters in the Netherlands, Mr. Wainwright says his agency, which employs 700 people, is uniquely situated to host a new European agency on terrorist financing and a separate cyber-crime center.

Organized crime is changing, he says. Criminal groupings are becoming smaller, more dynamic, more mobile and connected by the Internet. “You still have very powerful individuals with an awful lot of money, but they aren’t sitting at the top of a 500-strong army of violent criminals,” he says. Only in Italy do traditional mafia structures hold sway.

Mr. Wainwright says Europol is distinguished from Interpol, its global cousin, by its development of an “intelligence architecture” about “every serious criminal and terrorist activity” in Europe. The information is drawn from every police agency in the EU’s 27 nations and from some security-intelligence agencies.

The data, stored securely, are analyzed by more than 100 personnel, using advanced software, to identify new criminal patterns. He says Europol analysts were able to identify a criminal child-trafficking network based mainly in Romania, after London police arrested boys and girls aged mostly between 12 and 14 for pick-pocketing and cellphone thefts.

Europol’s “intelligence” functions are a touchy issue with some in Brussels. Before the agency was created in 1999, one German member of the European Parliament described it as a secret police force outside democratic control and with extensive snooping powers.

Mr. Wainwright’s own background—he was with Britain’s security service MI5 where he was a counterterrorism specialist for 10 years—makes him sensitive to criticism that the agency invades personal privacy.

“We are unique in the EU as an agency in the ability to collect so much personal data about the private lives of so many citizens in Europe,” he says. This “exceptional responsibility” has never been compromised in the history of the organization. In terms of protecting personal data, “it’s the most robust regime I’ve ever been associated with,” he says.

He points out that, while Europol increasingly goes on arrest operations—it coordinates 12,000 of them a year—the agency can’t take executive decisions, which remain with member states. “We don’t have arrest operations; we don’t even have surveillance operations. We don’t run our own informants,” he says. Terrorism is another area in which Europol is increasingly involved. Europol has moved into what the Europol director calls “frontline counterterrorist work” with a new EU-U.S. agreement that gives the agency responsibility to verify that U.S. requests for financial data from the SWIFT banking network satisfy legal conditions.

But the agreement has exposed the fact that Europe’s own system to track terrorist financing is underdeveloped. “At the moment we rely on having a by-product of the American system, which I think is not enough, given that we have a legitimate security interest in the threat as well in the EU,” he says. He says he expects EU interior ministers to adopt a European system to track terrorist financing—and task Europol with the role of managing it.

He also sees a lack in Europe of an institution to effectively coordinate the EU’s national cyber-crime centers. Governments have already agreed in principle to a new EU cyber-crime center, and a feasibility study is under way about where it should be located. “I expect that to conclude with a decision to establish the center here,” he says.

He says payment-card criminals in Europe have been using America’s low-tech card market to cash in on their criminal activity. Europe has largely abandoned using payment cards with magnetic strips because of the ease with which the information contained on them can be copied and replicated. European cards use a microchip and a unique identification number, sharply reducing payment-card fraud inside Europe.

Yet, because the cards are used by travelers to the U.S., they still carry a magnetic strip that can be read by criminals, who replicate them and use them to withdraw cash and buy goods in the U.S. Because of this so-called “payments migration fraud,” he says, the EU is putting pressure where it can on the U.S. government to change the technology, which so far hasn’t been adopted, in part for cost reasons.

Michael Rauschenbach, head of Europol’s money-forgery department, says magnetic tape is considered completely outmoded these days for storing music but seems still to be regarded as appropriate in the U.S. for storing sensitive personal financial information.

Mr. Wainwright says political decisions can often have economic benefits—but also help criminals. He cites the Schengen area, allowing free movement of people over national borders, and high-denomination euro bills. Large volumes of €200 and €500 ($282 and $704) bills—a boon to money launderers—return to Europe after having been shipped by drug traffickers to Colombia and laundered via the U.S., he says.

Source: http://online.wsj.com/article/SB10001424052748703739204576228840484172246.html?mod=fox_australian

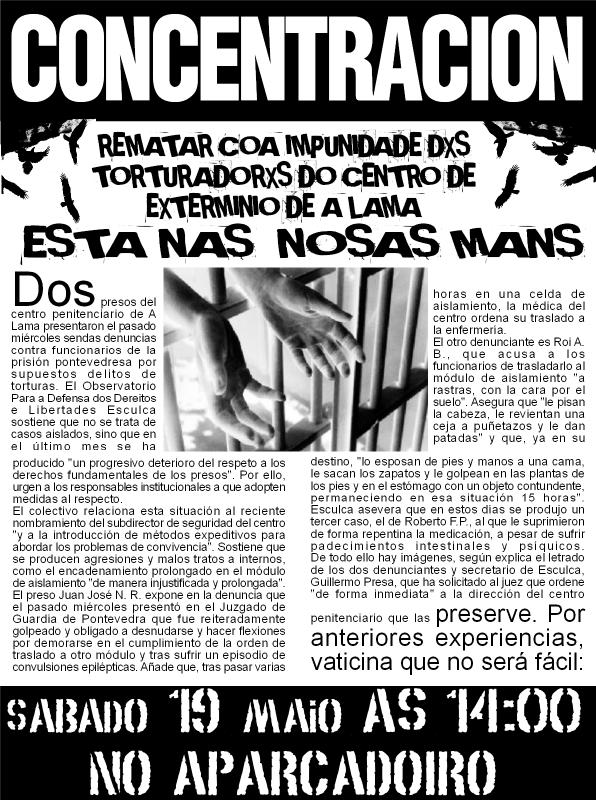

![Eurorepressione - Sulla conferenza a Den Haag sul tema "Anarchia" [corretto]](http://25.media.tumblr.com/tumblr_m0jvngOXtY1qa2163o1_1280.jpg)

![A tres años de la Partida de Mauricio Morales: De la Memoria a la Calle [Stgo.]](http://metiendoruido.com/wp-content/uploads/2012/05/mmacividad.jpg)

Nessun commento:

Posta un commento